colorado paycheck calculator adp

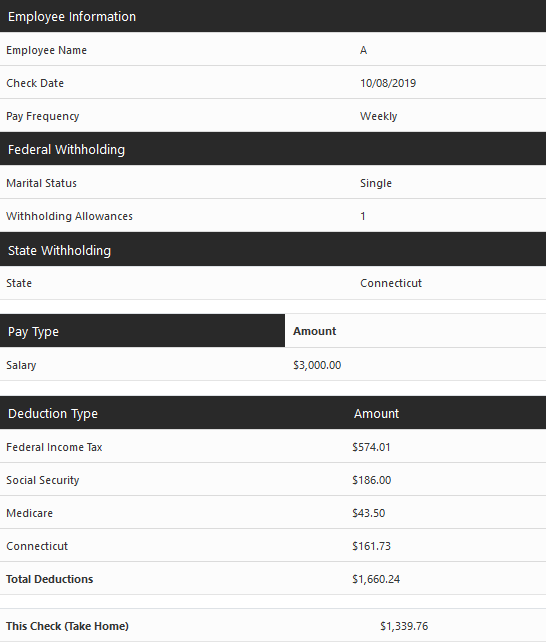

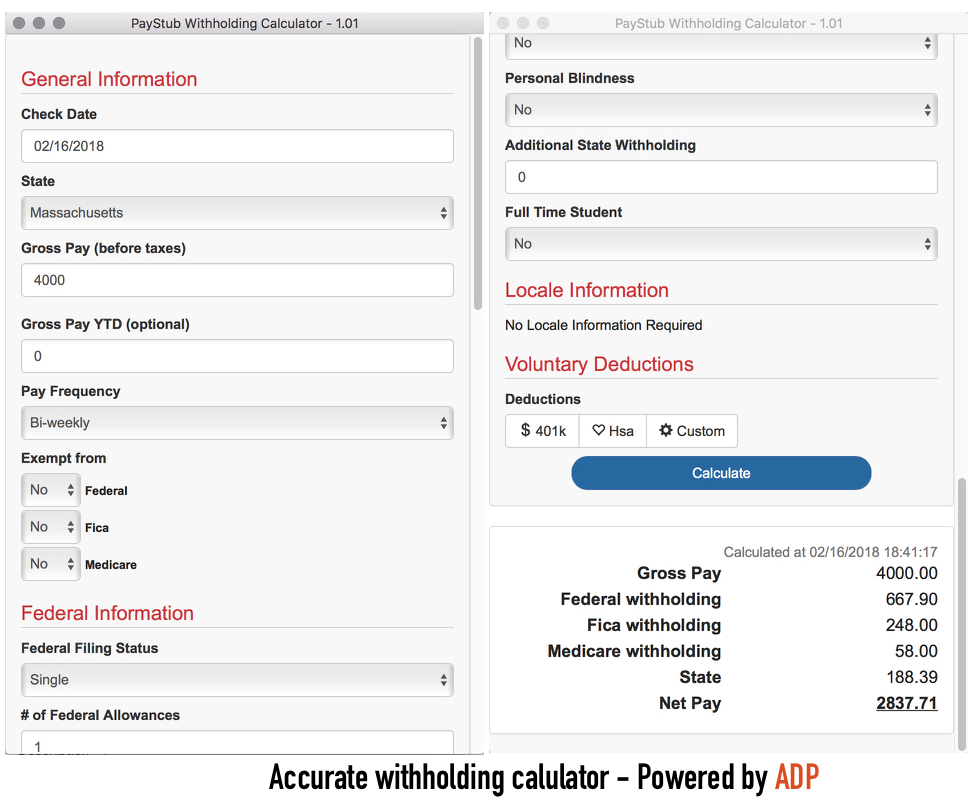

This link calculates gross-to-net to estimate take-home pay in all 50 states. Use This Federal Gross Pay Calculator To Gross.

Withholding Calculator Paycheck Salary Self Employed Inchwest

The information provided by the.

. How do I calculate hourly rate. For example if an employee receives 500 in take-home pay this calculator can be. Important Note on Calculator.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Colorado. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. Overview of colorado taxes colorado is home to rocky mountain national park upscale ski resorts and a flat income tax rate of 45.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For 2022 the unemployment insurance tax range is from 075 to 1039 with new employers generally starting at 17. Calculate net salary and tax deductions for all 50 states in the free paycheck.

Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment. Post date October 3 2019. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Post author By James. Colorado Hourly Paycheck Calculator. Use this Colorado gross pay calculator to gross up wages based on net pay.

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Well do the math for youall you need to do is enter. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. The colorado salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2022 and. Review Of Colorado Paycheck Calculator Adp 2022.

Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment. If you work in Aurora 2 is taken out of your pay every month if you earn over 250 in a calendar month. No Comments on Colorado Paycheck Calculator.

Plug in the amount of money youd like to take home. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. In Denver youll pay 575 monthly if you make more.

Important Note on Calculator. Secure File Pro Portal. These taxes are also flat rates.

Next divide this number from the. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. So the tax year 2021 will start from July 01 2020 to June 30.

Colorado Paycheck Calculator Adp. Colorado Salary Paycheck Calculator.

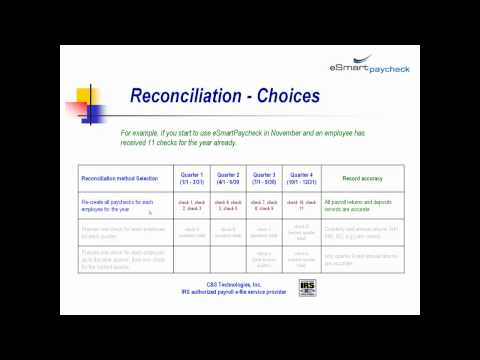

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Wisconsin Paycheck Calculator Adp

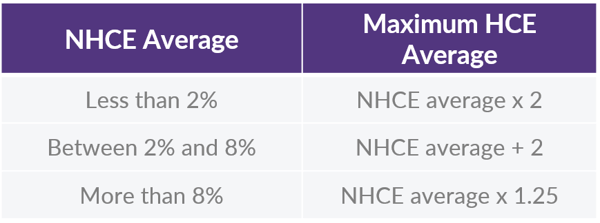

Nondiscrimination Testing Adp And Acp Tests Dwc

Nondiscrimination Testing Adp And Acp Tests Dwc

Colorado Paycheck Calculator Adp

Nondiscrimination Testing Adp And Acp Tests Dwc

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycor Review 2022 Features Pricing More Forbes Advisor

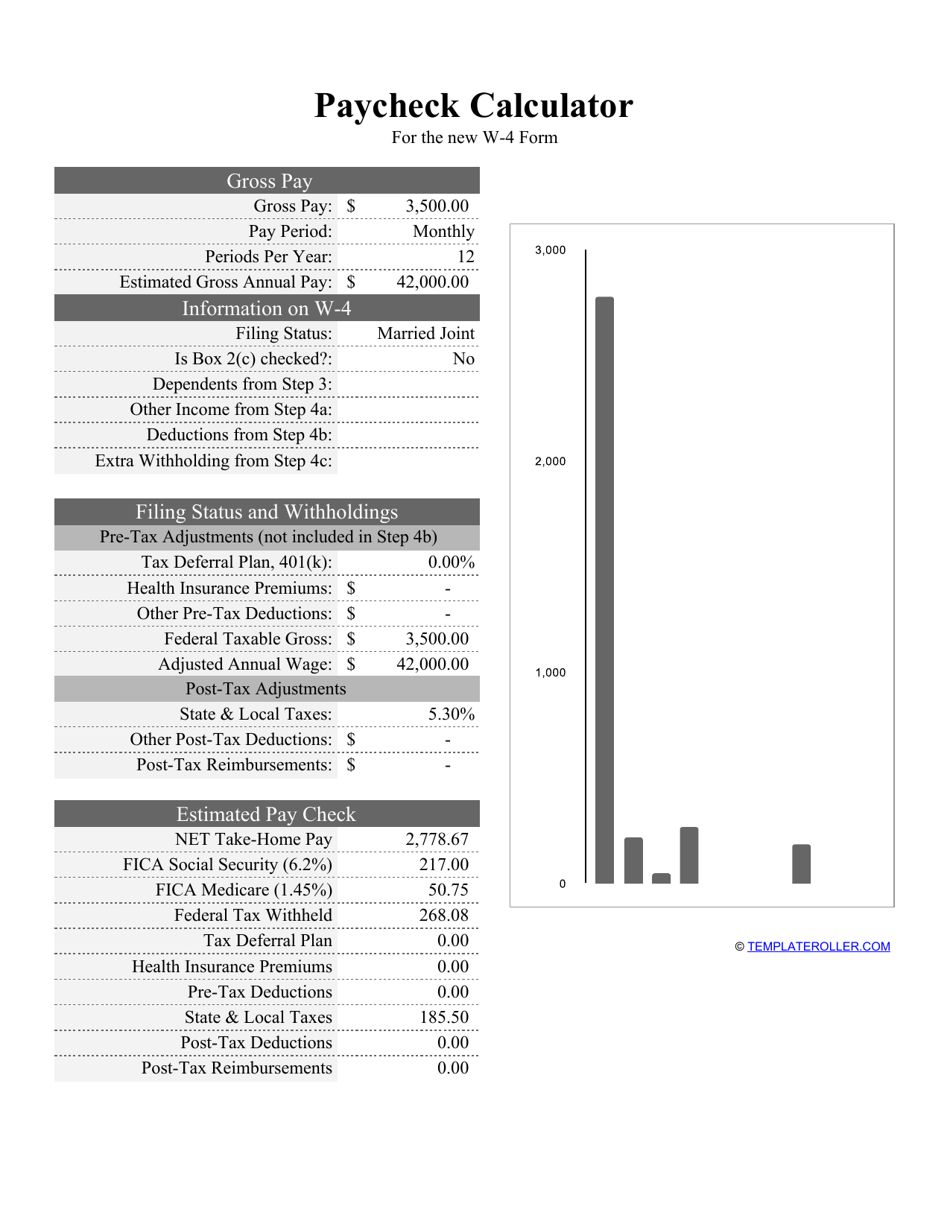

Paycheck Calculator Template Download Printable Pdf Templateroller

Colorado Paycheck Calculator Adp

Payroll Tax Calculator For Employers Gusto

Salary Paycheck Calculator Calculate Net Income Adp

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

New York Hourly Paycheck Calculator Gusto

Colorado Salary Paycheck Calculator Gusto

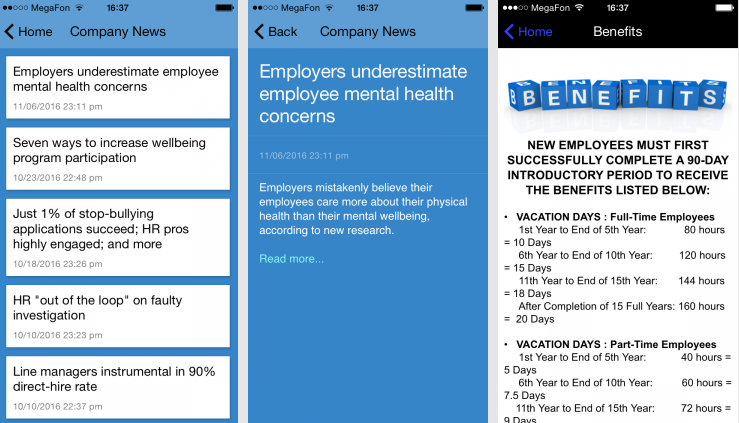

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Time Tracking For Pto And Vacation Accrual Exaktime

Complaint For Permanent Injunction And Other Equitable Relief